Travel

Latest Travel News

Festive Fever 2023: Locations To Go to Throughout This Season Of Celebration

India, with its wealthy cultural range and vibrant traditions, comes alive throughout the pageant season. The nation is understood for…

Purple Fort’s British-Period Barracks To Showcase India Biennale Exhibitions & Debut Structure Graphic Novel

From ornate doorways to historic magnificent temples and heritage stepwells to wealthy textile designs, the artwork and architectural legacy of…

Jharkhand’s Celebrated Waterfalls Teem With Guests As Festive Season Approaches

The well-known waterfalls of Jharkhand - Hundru, Jonha, Lodh, Dassam, Sita, Panchghag and Hirni - are brimming with guests forward…

Much less Than 12 months Forward Of 2024 Olympics, Resort Costs In Paris Surge By Three And Half Instances: Report

Lower than a yr forward of the 2024 Olympics in Paris, lodge costs are on the rise, growing by over…

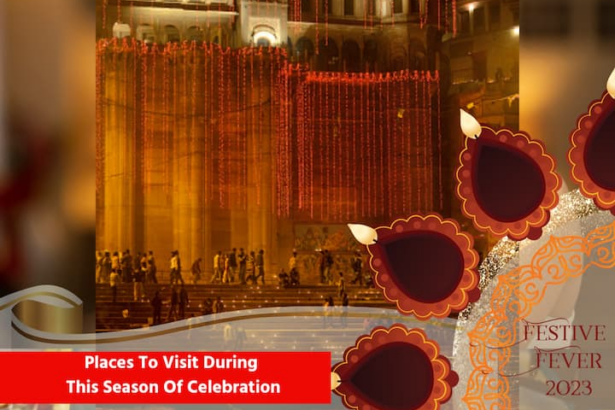

Pack Your Luggage And Head To Rajasthan’s Most Iconic Locations

Rajasthan is an Indian state adorned with a whole lot of forts, palaces, lakes, rivers, and antiques that make it…

Embracing The Open air: Prime 7 Newbie-Pleasant Nature Treks In India

India, with its numerous landscapes and breathtaking pure magnificence, provides a plethora of trekking alternatives for each freshmen and seasoned…

High Web sites For Discovering The Greatest Automotive Rental Offers In India

Within the ever-expanding world of journey, discovering the right automotive rental offers may be the important thing to unlocking a…

A International Affair — Navigating Australian Visa Necessities For Indian Travellers

Dreaming of exploring the beautiful landscapes, vibrant cities, and distinctive wildlife of Australia? Earlier than you embark in your journey…

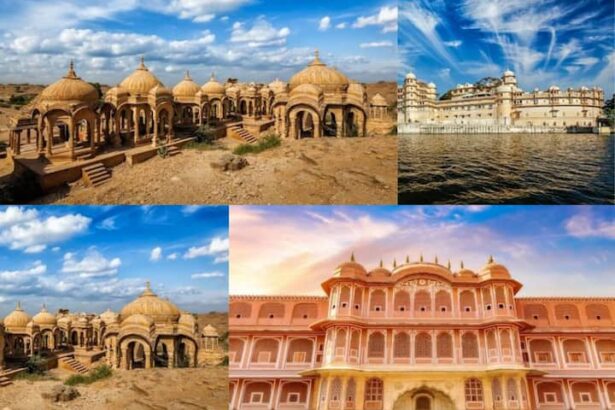

Gandhi Jayanti 2023: Prime Locations To Go to On This Event

Gandhi Jayanti is a day put aside to have fun and bear in mind Mahatma Gandhi's life and teachings. On…

Considering About A Lengthy Weekend Getaway? Think about These Locations Close to Delhi

Lengthy weekends are an irresistible invitation for travellers to hit the street and embark on a brief getaway to close…